di Daniele Langiu, Francesco Morello e Fabio Sdogati[1]

A clear understanding of the global macroeconomic scenario that is unfolding in this early part of 2016 requires a clear understanding of the main drivers of economic growth over the last quarter of a century. During these last 25 years, globalization led to growing GDP in both high per capita income countries and a subset of developing economies thanks to increased economic integration, increased international flows of people, products and capital. The pattern of the wave of globalization that drove economic growth can be summarized in three points:

- Rising of economic integration between the US and China (and between them countries and their suppliers, that is the countries of Southeast Asia but also Latin America, Brazil in particular, and Africa);

- Emergence of a process that would lead to the end of the ‘Made in’ production model and the emergence of international fragmentation of production processes (‘global production networks’ in the language of economists, ‘global value chains’ in management’);

- Acceleration of the project of a European Union (EU) and Economic and Monetary Union (EMU).

- United States and China

Today (2016) it is well understood that China’s growth is a crucial determinant of the world’s economic growth. But it was not at all so a quarter century ago. Back then, demand was not coming from China in appreciable proportions, nor was it coming in appreciable proportions from the BRICS: which were ‘developing countries’ among many others, not yet ‘emerging economies’. Thus, the big bulk of aggregate demand came from high per capita income countries, and its management was ‘obviously’ the turf of the respective national governments (back then public spending was not a sin the way it is in Europe since 2009).

But then the US discovered that the Chinese economy, appropriately helped out through a sustained process of technological transfer, could indeed become that supplier par excellence for all those goods that for being produced, at least initially through technologies highly intensive in unskilled labour, it was no longer reasonable to import from Europe, where labour costs were beginning to raise way above those prevailing in ‘developing countries’. This is why the nineties witnessed to the growing volume of trade between US and China, which, year after year, soon became the largest bilateral trade on record in the world. And, not to be forgotten, an exchange that was to supply the US not just with cheap imports, but with cheaper and cheaper imports: China was helping the US fight domestic inflations by letting domestic Chinese wages raise more slowly than Chinese productivity.

- Global Production Networks

It is by now generally accepted in the economics literature that the wave of globalization that spiked around the last decade of the XX century found its roots in three developments that set out right after WW2: falling transport costs; falling tariff and nontariff protection that were impeding free circulation of goods and capital; the advent of the internet, the main source of cost savings in the process of coordinating purchases, production and sales at the global level. Business’ incessant search for ever lower costs of resources, human and material and the parallel research for source of demand for their own products and services additional to that generated with the high per capita income countries led over the years to a process of gradual fragmentation of production processes in manufacturing. A growing number of manufacturing units sought involvement in production networking in a growing number of countries. The extent of the new, global organization of production is such that in 2011 the president of the World Trade Organization declared publicly that by then it would be difficult to imagine of a single good, even apparel, that could be rightfully bear the ‘made in’ (just one country) sign.

- The European Union and the Euro

The European leadership could not easily stand witness to the great changes taking place in the world production structure without correctly inferring that, indeed, size matters. They correctly moved to accelerate the process of European economic and monetary integration as a way to build up that size which could place it on a terrain of ‘equals’ in the global division of labour (geopolitical issues are not of interest in the present context). From a theoretical point of view, nothing revolutionary in this choice, of course: had it not been Adam Smith himself, in 1776, to explain once and for all that the division of labour is the greater cause of productivity increases and, thus, of the wealth of the nation? And that, in turn, it is an increasing market size that drives productivity increases? It was true then, it is true now. It followed straightforwardly that what Europe needed was a single European market. Therefore, it is that on we went with the establishment of the European Union on January 1, 1993; with the European Economic and Monetary Union (‘the Euro’) on January first 1999; with the Eastern Enlargement, as it was called back then, to include membership of fourteen additional members from Central-Eastern Europe. Today, the EU counts 28 members, the EMU 19. Thus, size is there.

Thanks to a healthy dose of optimism shared across the Atlantic, economic globalization and, hence, economic growth, seemed to be a never-ending story…until the so-called ‘subprime crisis’ in the US market. The financial crisis came to the European public’s attention on August 7, 2007, when BNP Paribas called a press conference to announce that three of its mutual funds were no longer solvent.[2] As time went by the ‘subprime crisis’, as the problem was thought to be in the early days, became a ‘credit crunch’, then a ‘Great Recession’ and finally, on October 22, 2009 a ‘sovereign debt crisis’. It is worth to remind everybody that the Great Recession began as a financial crisis triggered by the banks’ behavior with derivatives, and that it spread worldwide through a highly connected financial system and ultimately caused a sharp slowdown of the real economy, itself tightly connected through international trade. The consequences of The Great Recession have been, and still are, very negative, resulting in sharp contraction in per capita and overall real GDP – in particular in high per capita income countries, so far – and skyrocketing unemployment rates (especially among the young).

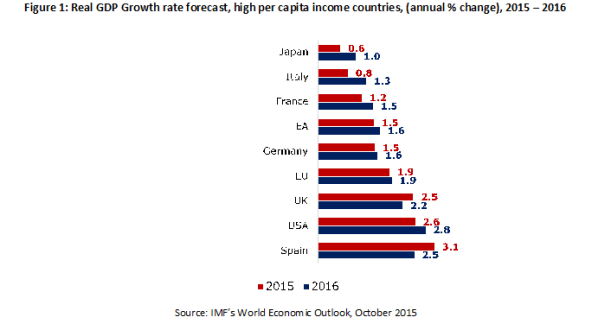

The global economy is still recovering from several recessions (one in the US, two in Europe and three in Italy since August 2007) and the last IMF economic outlook (Figure 1 and Figure 2) confirm that emerging market and developing economies will lead the global economic growth in the next year. In addition, virtually all high per-capita income economies have returned to growth, though not at rates that one should be writing home about. The Euro zone economy is forecast to grow 1,6 per cent in 2016, up from 1,5 per cent in 2015; the UK is forecast to grow by 2,5 per cent and the US by 2,8 per cent, Japan by 1,0 per cent in 2016, up from 0.6 per cent.

Still, when considering these signals of improvement, three elements should be fed into the coming economic scenario:

- Turmoil and macroeconomic adjustments in emerging market economies will weaken the global economic growth by reducing trade flows from high per capita income countries and putting downward pressure on commodity prices;

- The FED’s interest rate hike on December 17, 2015, the first time in nearly ten years, could put pressure on emerging market economies by forcing their currencies to depreciate further against the dollar, and spur continuing capital outflows toward the US;

- High per capita income countries could face a period of protracted stagnation (Secular Stagnation) characterized by very sluggish GDP growth due to a variety of factors, foremost among which will be a persistent, chronic aggregate demand deficit.

- Turmoil and macroeconomic adjustments in emerging market economies

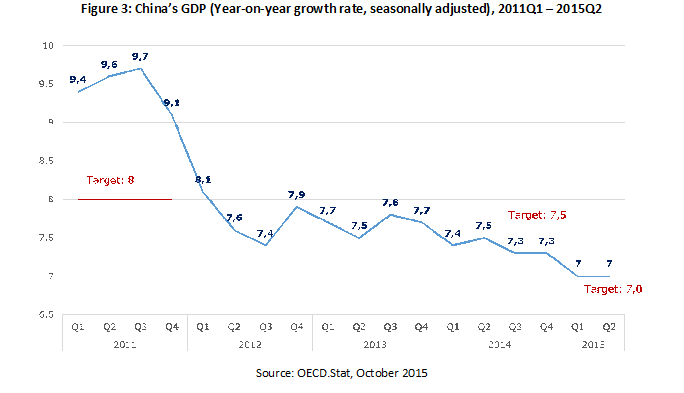

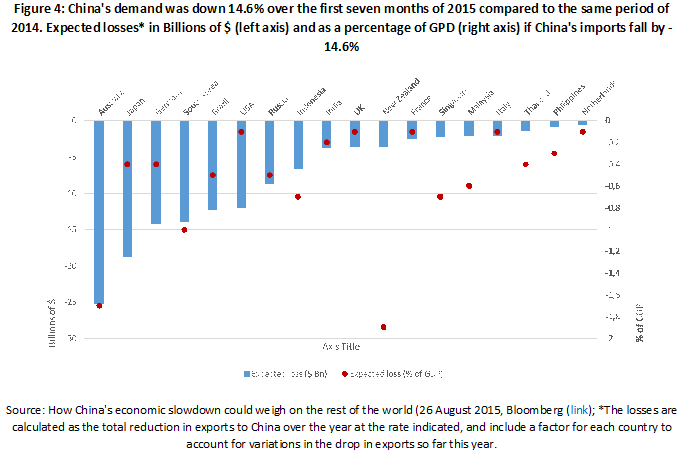

Turmoil and macroeconomic adjustments from emerging market economies, especially from China and its closest trading partners, could weaken the scenario further, thus prolonging the waiting time to full recovery. Specifically, on June 2015 the Chinese stock market began to tumble; the Shanghai index fell 30 per cent in just three weeks. By July 3 the Shanghai and Shenzhen exchanges had shed almost Rmb18.6tn ($3tn) in market capitalization. But we believe the most worrying aspect of Chinese economy to be its real GDP slowdown: since 2011, Chinese GDP has slowed its pace of growth (Figure 3), but only during the last year investors have feared that its effects (and stock market crash) could spillover to Chinese main trading partners, in particular commodity exporters to China and, thus, undermining their growth as well (Figure 4).

Although a slowdown could be expected when the Chinese authorities attempt to manage a transition in the economy away from investment in building and infrastructure towards greater internal consumption of goods and services to transform its growth model, the main concern is the pace at which the Chinese economy slows. After a decade during which demand for commodities boosted emerging market economies around the world, a slowdown in buying has spurred a collapse in prices for raw materials and widespread pain for their producers.

- FED tightening

On December 17, The Federal Reserve raised short-term interest rates for the first time in nearly a decade, calling an end to the near-zero borrowing (by banks) costs that have prevailed since the Lehman Brothers collapse in the Autumn of 2008. The Fed’s median forecast of its own ‘dot plot charts’ suggests rates will be hiked a full percentage point a year until they hit 3,25 per cent at the end of 2018. This is about half a percentage point above current market expectations for the end of 2016 and about a full percentage point above market expectations for the end of 2018. Although last year US payroll have exceeded market expectations and have led to a greater confidence that US economy is ‘on track’ again, some economists (among all, Lawrence Summers) have suggested that the FED move has been too hawkish, that is, the FED would have underestimated the risks implicit in hiking rates. It is worth remembering that FED mandate is promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates. Although the US unemployment rate on November 2015 was 5,0%, US inflation was still below the rate of 2 percent, judged consistent over the longer run with the Federal Reserve’s statutory mandate. Moreover, wages and salaries have been growing at a rate well below the pre-crisis peak, signalling that labour supply still exceed labour demand. Add to this US ‘internal’ concern, FED rate hike could threaten emerging market economies financial stability. As Summers pointed out: “Any change in policy and financial conditions carries with it at least some chance of setting off instability which could snowball given the current high degree of illiquidity in many markets. The risks are magnified by the asymmetry between what the Fed is doing and what most other major central banks are doing. While in principle exchange rate movements should not affect the level of global demand, further dollar appreciation is likely to be contractionary for the global economy because of the uncertainty it engenders.”

- Secular Stagnation in high per capita income countries

On November 16, arguing that the crisis is not over, Summers raised the concern that the stagnation – i.e. a chronic demand deficit – might prove to be the new normal. There are several reasons for this: I) a saving glut coming from Asia; II) a long-term IT-induced decline in the relative price of capital goods that has reduced needed investments relative to available savings; III) declining rates of population and productivity growth; IV) increasing inequality of income distribution.

Conclusions

Our analysis point to at least two years of very slowly-growing world economy, punctuated by recessions affecting some countries but not actually taking hold in the world at large. This we believe to be a strong result. The problem therefore is of the following nature: are we facing a ‘trivial’ problem of aggregate demand stagnating at the same time in high per capita income and emerging economies over a period of at least a couple of years? If such were the case, the solution would be on the demand side of the economy: it would ‘suffice’ to follow the November 2008’s G20 decision to have the Chinese Government to hike its deficit spending and the February 2009’s US Congress to do the same. Consistently with its choice of generating excess savings through so-called austerity policies, Europe would keep out of the stimulus picture, thus hoping to be able to collect the crumbs of other countries’ expansions through increased demand for its exports.

The alternative scenario would be that the roots of the stagnations run deeper that a ‘simple’ lack of aggregate demand. The hypothesis up for discussion is that lack of demand is just one of worrisome factors that, all together, would lead to what has been dubbed a secular stagnation. These factors, listed above, might have been leading to a structural, or permanent, change in the model of production and accumulation of wealth that we have been experiencing from WW2 to the credit crunch of 2007. In the latter hypothesis aggregate demand of a size adequate to a world stagnation would be still the first and foremost anti-recession tool. But a secular stagnation would require a set of policies much larger and diversified that ‘just’ demand management. Problem is governments seem to have disappeared from the radar. European ones especially.

The US and other major global economies might not return to full employment and strong growth without the help of unconventional fiscal policy support, aimed at stimulating aggregate demand and, hence, gross domestic product. This include, for example, raising minimum wages and reducing income distribution inequality; investing in productive infrastructures, adopting a fiscal stimulus funded through base money issuance or a deficit-financed fiscal stimulus.

[1] Reprint from “The Global Macroeconomic Scenario”, Impiantistica Italiana, Gennaio – Febbraio 2016.

[2] Of course, the American public had been made aware of the situation already in the Spring when the Bear Sterns difficulties were already the talk of the day.