20 03 28

Daniele Langiu daniele.langiu@gmail.com

Fabio Sdogati fabio.sdogati@mip.polimi.it

In this paper we submit an interpretation, or ‘a model’, of the current crisis. We hope to shed some light on the endogenous mechanisms that are making the crisis costly both in humanitarian and economic terms, probably longer-lasting than many still imagine, or hope, and difficult to control in the absence of extreme intervention, as compared to historical, peace-time standards, by fiscal and monetary authorities the world over. Our question is: what can be said about the post-shock path of the crisis, from shock to recovery?

- The original shock and the trade-off facing firms and Government

The natural point of departure, the original shock is, obviously, the epidemic tracked first in Mainland China. Thus, a health shock. This type of shock posed a challenge that, though not unknown, was on such a massive scale not experienced even at the time of SARS in 2002. The challenge is easily described: firms, and the Government even more, were facing a dilemma in the form of a trade-off between health of the population and productive activity. As we all know by now, confronting the epidemic requires, among many other types of actions, social distancing in each and every conceivable occasion: entertainment, transportation, and, of course, work. The level of trade-off adopted is, in the end, a political choice. [We have no interest in issuing judgement on the Chinese Government’s choice of ‘optimal ‘trade-off.]

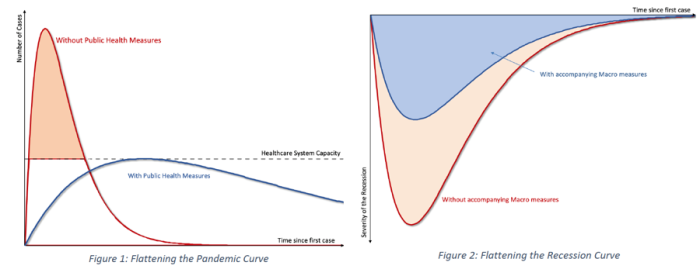

The trade-off can be represented with the help of two graphs (Figure 1) taken from the research published on March 13 by Pierre-Olivier Gourinchas, Professor of Economics at the University of California-Berkeley. The graph on the left illustrates the benefits of containment pandemic policies and, by contrast, the graph on the right shows that a flatter curve for the pandemic, potentially the result of measures of social distancing and suspension of production, has its counterpart in a deeper curve for the recession, and vice versa.

Figure 1: Flattening the pandemic curve and the recession curve

Source: Pierre-Olivier Gourinchas (13th March 2020), “Flattening the Pandemic and Recession Curves”, https://drive.google.com/file/d/1mwMDiPQK88x27JznMkWzEQpUVm8Vb4WI/view

- The health shock generates a demand-side shock

As a growing number of employees are not admitted to work, production necessarily shrinks. This appears to be just a supply side shock. Using an introductory economics textbook analysis of supply shocks, some economists came up with the idea that shrinking supply at a given level of demand will necessarily generate inflation.

We do not buy it. What happens when employees are laid off one way or another, their incomes fall and, assuming their marginal propensity to consume does not rise, their level of expenditure will fall: the demand schedule shifts downward, and the new equilibrium will take place at a lower equilibrium level of income and at basically unchanged prices.

No, inflation is not the outcome of a health shock.

- The shock to production reverberates through global production networks

The full extent of the original supply-side shock can only be appreciated if we duly understand that this is not a national phenomenon. Firms operating in the country first hit by the epidemic and the induced economic shock are known to be integrated in global production networks. These firms import components and intermediate inputs from firms located throughout the world, and in turn export their intermediate inputs to them, as well as final good to domestic and foreign consumer markets.

To keep the analysis simple, imagine that Chinese firms shutting down production start cutting orders for intermediate inputs from Italian manufacturers. Chinese demand for Italian output falls; production in Italy shrinks; employees are laid off; their demand for goods and services shrinks, thus putting further pressure on production. In short, in Italy a supply shock gives rise to a demand shock as well. Is that all?

Unfortunately, as we well know, it is not: just as the pain from falling demand from China hits Italian manufacturing, the epidemic hits the whole country. Now we have a situation in Italy very much resembling the Chinese one: double shock, trade-off between production and health. [Again, we have no interest in issuing judgement about the political choices of the Italian Government.]

In addition, it is important to emphasize that the process is dynamic, in that the crisis situation in Italy follows the one in China; and that the shock is of two natures, and they appear to be intertwined, regardless of whether one or the other comes in first in any given country.

Assume now that Italian manufacturers also supply German manufacturers with intermediate inputs, as well as China. Everybody’s thought will go to the automotive sector, of course. Interesting to see how complex the model becomes in the third round: German producers lack intermediate inputs from both China and Italy; production slows down; and just right at the same time, the pandemic hits. Assuming there was demand for automobiles, satisfying it would be difficult. Figure 2 exemplify what happens to world GDP when the health shocks hits subsequently several countries.

Figure 2: A model for interpreting how a multi-nature, multi-country, multi-hits shock impacts the GDP

- Falling global demand

Unlike what is described in introductory-economics textbooks, the crisis takes on the form of a lack of demand. We do not mean to underplay the tremendous impact of the original shock on the global supply chains –we have devoted the whole of paragraph 2 to the issue. But neither can we overlook the fact that there is tremendous lack of buyers out there, and there will be fewer and fewer as the pandemic progresses and consumers will become fearful of falling incomes while entrepreneurs will grow more and more negative demand expectations, something that will reflect on their willingness to take entrepreneurial risks.

Most of us use war as a metaphor for the current crisis. That is most useful to give an idea of the size and gravity of the situation. Fine. But one similitude we cannot draw is about the relevance of the supply shock. In a war, the supply shock comes through a falling labor supply as man and women are withdrawn from production to serve, as well as a destruction of infrastructure and productive capital such as machinery and factories in general. We know that no infrastructure or productive units are being destroyed, a fact that makes the current supply shocks less dramatic that those associated with a war.

Demand, takes center stage. Global demand. Here we identify just a few of the many factors putting downward pressure on demand:

- Falling employee incomes as unemployment develops through paid or unpaid leave

- Falling firms’ sales and profitability

- Increasingly negative expectations about incomes and sale

- Falling marginal propensities to consume and to invest for any level of income

A more detailed and complete analysis of how the COVID-19 crisis has struck the economy has been presented by Richard Baldwin, Professor of International Economics at The Graduate Institute of Geneva.

- Policy implications

We have written in previous articles that now more than ever we need a coordinated intervention at European level and Central Banks and Governments should use their tools to support the global economy.

The crucial point for Central Banks is probably this: Central Banks be Central Banks, that is, lenders of last resort. One way to accomplish this is by adopting strong coordination between Central Banks that guarantee unlimited credit lines to each other to avoid cash run problems. Central Banks have already adopted expansionary monetary policy, mainly through[1]:

- Cutting interest rate

- Creation of swap line arrangements

- Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, and the Swiss National Bank announced a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements (March 15th) and, then, they announced enhancement of the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements (March 20th);

- Then, the Federal Reserve announced the establishment of temporary U.S. dollar liquidity arrangements (swap lines) with the Reserve Bank of Australia, the Banco Central do Brasil, the Danmarks Nationalbank (Denmark), the Bank of Korea, the Banco de Mexico, the Norges Bank (Norway), the Reserve Bank of New Zealand, the Monetary Authority of Singapore, and the Sveriges Riksbank (Sweden) (March 19th);

- ECB and Danmarks Nationalbank reactivated swap line to provide euro liquidity (March 20th);

- Adoption of asset purchase programme

-

- European Central Bank announced €750 billion Pandemic Emergency Purchase Programme (PEPP) (March 18th);

- FED decided to increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion (March 15th);

- Federal Reserve adopted several actions to support the flow of credit to households and businesses (March 15th,March 17th, March 18th, March 20th).

Public intervention is needed when an entire country is (rightly) quarantined; and this is what Governments have been doing. Indeed, Governments have decided to adopt expansionary fiscal policies and are discussing even wider ones[2]:

- Italian government approved a 25 billion-euro ($28 billion) package to support its health system while helping businesses and families counter the economic impact of Europe’s worst coronavirus outbreak (March 15th), up from an initial plan of injecting €3.6bn (March 1st);

- President Trump signed an $8.3 billion spending bill (March 6th), then signed the “Phase Two” of the stimulus (March 19th) and, finally, US congressional leaders agreed on a $2tn stimulus deal (March 25th);

- German Government authorized its state bank, KfW, to lend out as much as $610 billion to companies to cushion the effects of the coronavirus (March 13th) and is considering stimulus measures requiring about 156 billion euros in net new borrowing and additional debt authorization of up to 200 billion euros (March 21st);

- French Finance Minister announced a $49 billion aid package (March 17th).

Moreover, given the seriousness of the situation, the Economic and Monetary Union decided on March 20 to suspend the Stability & Growth Pact, thus giving room to member countries’ governments to push deficit spending beyond the limit of 3 % of GDP and, therefore, to adopt expansionary fiscal policies wider and more far reaching than those authorized to date.

- Conclusions

An original supply-side shock in one country has morphed into a demand-side shock as well, and both are travelling in space and time. Each passing day a larger number of casualties of the epidemic is registered the world over; and each day the trade-off between public health and production tilts in favor of more health and less production.

The present crisis is going to be long lasting, severe in humanitarian terms, expensive in economic terms, both from the production and the employment point of view.

There will be scant chances to succeed against both crises without a massive, generalized, unprecedented, coordinated intervention by fiscal and monetary authorities the world over. We have registered that such reactions are coming through at a reasonably fast pace. Whether those policy measures, adopted and announced, are ‘sufficient,’ we do not know, just like nobody else does.

[1] We have highlighted the main monetary policy adopted up to 26th March 2020.

[2] We have highlighted the main fiscal policies adopted and under discussion up to 26th March 2020.